Basic return on investment calculation

Conversely the formula can be used to compute either gain from or cost of investment given a desired ROI. The main exception to this rule is if a federal employee retires after reaching age 62 with at least 20 years of creditable service and in this case the percentage increases to 11.

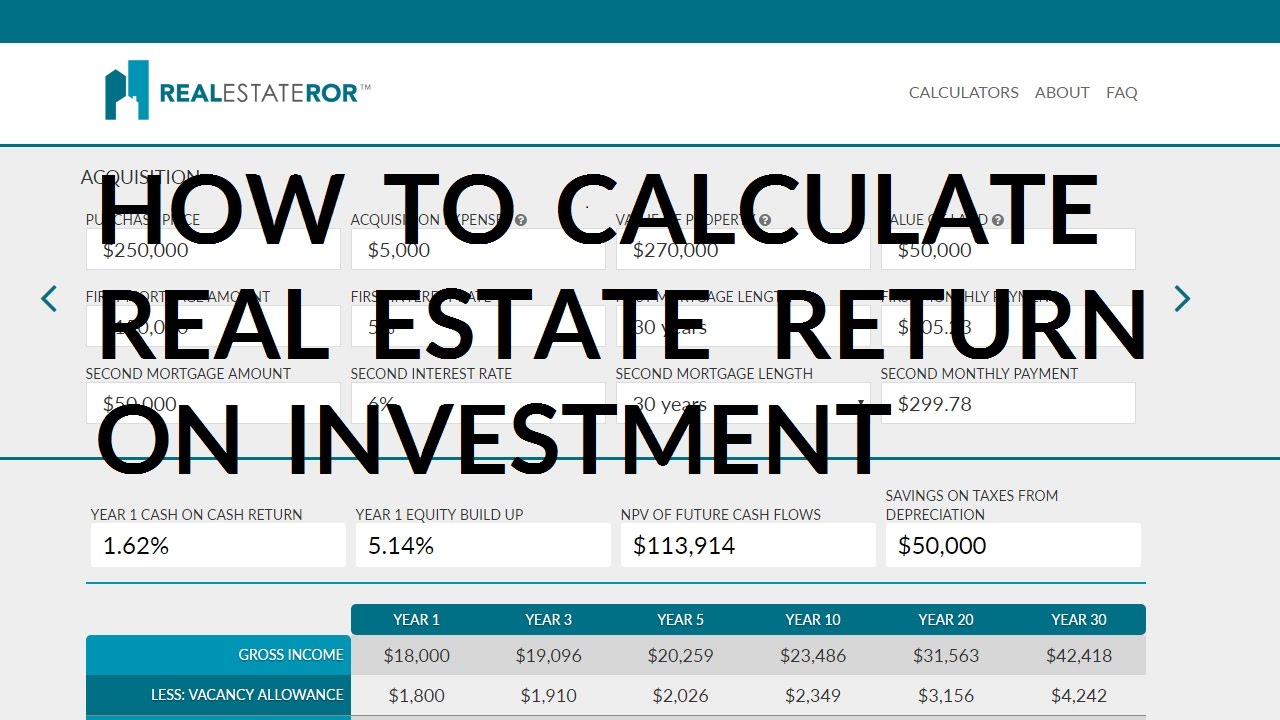

Get Our Image Of Real Estate Investment Analysis Template Mortgage Comparison Investment Analysis Income Property

Social Return on Investment SROI is a systematic way of incorporating social environmental economic and other values into decision-making processes.

. Our estimate of the annualized percentage return by the investment including any periodic investments. It comprises any change in value of the investment andor cash flows or securities or other investments which the investor receives from that investment such as interest payments coupons cash dividends stock dividends or the payoff from a derivative or structured productIt may be measured either in absolute terms. Investment Banking Accounting CFA Calculation and.

By helping reveal the economic value of social and environmental outcomes it creates a holistic perspective on whether a development project or social business or enterprise is beneficial and. The percentage used in the calculation is typically 1 of creditable service. Basic pay does NOT include bonuses overtime pay.

For example if sales dropped 1000 a month on average for the previous 12-month period and a 500 marketing campaign results in a sales drop of only 200 that month then your calculation. Return on investment ROI measures how effectively a business uses its capital to generate profit. Therefore for Number of Cash Flows enter 120 4 times a year for 30 years.

This is easy to calculate and easy to understand. If you find these four options dont give you enough information you can try a different type of calculation. Disadvantages and Modifications of this Method.

If Bob wanted an ROI of 40 and knew his initial cost of investment was 50000 70000 is the gain he must make from the initial investment to realize his desired ROI. If one investment had an ROI of 20 over five years and another had an ROI of 15 over two years the basic ROI calculation cannot help you determine which investment was best. This is a scale that primarily looks at how much profit an investor makes over a specified period from their investment in a particular company.

In finance return is a profit on an investment. The final value will show the actual ending balance if you want to compute a total return instead. As noted earlier there are three main methods for computing investment performance results.

First let us look at the calculation of the basic EPS of Starbucks and its interpretation. And set the InvestmentIncome Frequency to Quarterly Set the Annual Rate of Return to a value with which you are comfortable. There are many alternatives to the basic and complex ROI formulas described above.

The higher the ROI the better. Unlike the MoM the IRR is considered to be time-weighted because it accounts for the specific dates that the cash proceeds are received. It simply divides the change in value over the time period by the starting value at the beginning.

Here the amount of gratuity that one gets depends on the half months salary for each completed service year. It would help if you also looked at other financial ratios like return on total assets ROCE ROCE Return on Capital Employed ROCE is a metric that analyses how effectively a company uses. The calculation of the IRR involves the following steps.

ROE is primarily concerned with stocks and the stock market. The salary last drawn carries the basic salary commission on the sale and dearness allowance. ROI is arguably the most popular metric to use when comparing the attractiveness of one IT investment to another.

But you might want to be a bit more aggressive than we were with the Rate of Return used in the first calculation. The result is the annualized return in percent which however is not as accurate as the internal rate of return method if cash flows occur between the first and last periods. Return On Investment - ROI.

Higher ratio indicates that the companys product is in high demand and sells quickly resulting in lower inventory management costs and more. A performance measure used to evaluate the efficiency of an investment or to compare the efficiency of a number of different investments. Bobs ROI on his sheep farming operation is 40.

ROI measures the amount of. Calculation of Inventory Turnover Calculation Of Inventory Turnover Inventory Turnover Ratio measures how fast the company replaces a current batch of inventories and transforms them into sales. The value of the ETF or CEF investment on the Ending DateAgain note we may change that date depending on the database refresh limit.

But it doesnt have to be. Return on investment ROI is a financial ratio that calculates the benefits an investor gets compared to the cost spent on a project. The internal rate of return IRR metric estimates the annualized rate of return that an investment is going to yield.

The 1530 calculation represents 15 days out. It measures how effectively a company is using investors money. Basic TWR and DWRIRR.

This approach assumes that all returns occur in the form of a single cumulative inflow in the last period of the investments tenor. Methods of Computing Investment Performance. Basic or Simple rate of return.

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Budgeting

Return On Investment Investing Financial Analysis Accounting Education

Calculate Return On Investment For A Rental Propertyhttps Iqcalculators Com Calculator Real Estate Investing Financial Calculators Investment Companies

Roi Calculation Investment Tips Investing Digital Marketing

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

How To Calculate Roi On A Rental Property To Find Great Investments Real Estate Investing Investing Real Estate Investing Investment Property

Financial Definitions Rule Of 72 Rule Of 72 Investing Mental Calculation

Roi Calculation Investment Tips Investing Digital Marketing

Install Rate Calculator The Online Advertising Guide Online Advertising Advertising History Digital Marketing

How I Select Stocks For Long Term 40 Return In Two Days Overall 200 Return Stock Youtube Stock Market Stock Market Basics Term

Simple Interest Si Calculator Formula Simple Interest Math Charts Formula

Pin On Books To Read

Lapith On Twitter Customer Lifetime Value Customer Retention Lifetime

The Rule Of 72 Explained Rule Of 72 Investing Mental Calculation

Roi Return On Investment Measures The Gain Or Loss Generated On An Investment Relative To The Amount Of Money Investing Financial Tips Marketing Professional

Simple And Compound Interest Meaning Formula And Example Compound Interest Investment Compound Interest Accounting Education

De Mystifying Roi Calculation For Sharepoint Sharepoint Investing Success